30yr Bond London Open “Bread & Butter” Trade

When trying to find high probability setups, the following three questions should always be answered: What to look for? Where to look for? When to look for?

The “when” is usually the most important question: patterns and setups often fail because they appear in an unfavorable market context. It can be very frustrating to execute a trade and then wait for a follow-through that never happens… Knowing the “when” usually requires no secret forecasting skills, just common sense.

Although the question of “when to trade” is a complex one, there are very simple guidelines to follow: one of them is to focus on the most active periods of a market.

Electronic markets trade 24 hours a day, around the clock, and their activity changes constantly as different financial centers around the world go live. Two very important periods for ‘Opens’ are the London/EU and the US Open periods.

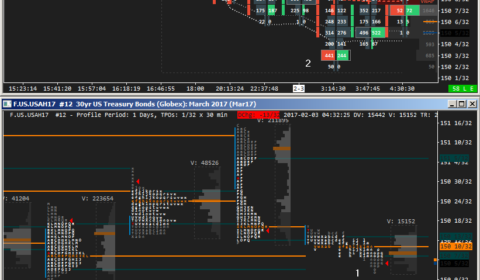

Below you can find an example of a ‘pattern’ called London Open Trade that repeatedly happens around the European morning hours when the UK and EU open (around 2-3 AM EST).

‘WHEN & WHAT’: expect (1) increasing momentum and volume and (2) a sharp change of the direction of the previous Asian session around the London Open (2-3 AM EST).

- After a Double Distribution Sell-off day on 2 Feb, the price ground down slowly during the Asian session to the 1 Feb VAL level

- Right after the European Open (Period ‘o’) found support at 153-03 (Buy imbalance) and reversed back to the daily VWAP/VPOC level.

Last updated: December 8, 2023 at 17:26 pm

Uploads are powered by Proton Drive, MEGA, and Vultr.